AP Microeconomics/Macroeconomics Premium, 2024-Money and Banking

Multiple-Choice Review Questions

1. Which of the following is not included in M1?

(A) Coins

(B) Federal Reserve Notes

(C) Demand deposits

(D) Small time deposits

(E) Other checkable deposits

2. Which of the following is not included in M2?

(A) Currency

(B) Demand deposits

(C) Other checkable deposits

(D) Savings accounts

(E) Credit cards

3. Which of the following statements is true?

(A) Some of the things included in M2 are not as liquid as the things in M1.

(B) M2 is smaller than M1.

(C) M1 is backed by gold, and M2 is backed by silver.

(D) The biggest component of M1 is currency.

(E) The biggest component of M2 is currency.

4. Fiat money

(A) is not backed by any precious commodity.

(B) can be exchanged for gold.

(C) is backed by gold but cannot be exchanged for it.

(D) is not legal tender.

(E) can be backed by gold or silver.

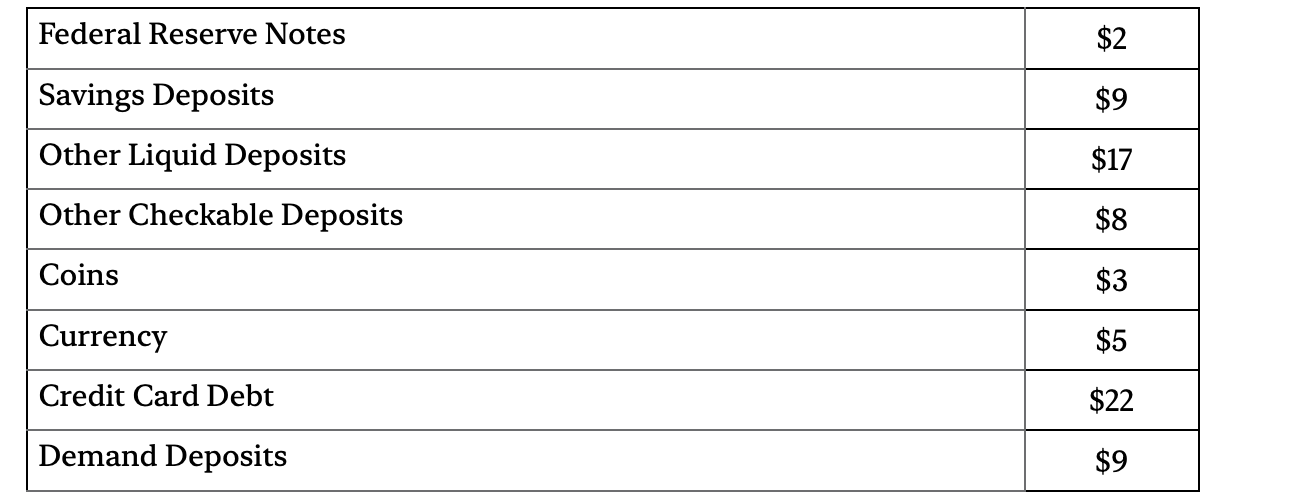

5. Given the table, M1 = ___.

(A) $21

(B) $22

(C) $31

(D) $36

(E) $53

6. Required reserves

(A) can be used by banks to make loans or buy investments.

(B) can be held in a bank’s vault or its account at the Fed.

(C) must be kept in a bank’s vault.

(D) must be used to make loans.

(E) ensure that banks will have enough cash on hand to meet their withdrawals.

7. The secondary market for government securities is

(A) where used items are traded.

(B) located in smaller cities.

(C) where the government borrows money.

(D) where government securities that have already been issued may be bought or sold.

(E) where government securities are issued.

8. If the reserve requirement is 2 percent, then the money multiplier is

(A) 5.

(B) 5 percent.

(C) 50.

(D) 50 percent.

(E) one-half.

9. If the Fed buys bonds in the secondary market

(A) the monetary base will increase.

(B) the monetary base will decrease.

(C) the monetary base will not be affected.

(D) the discount rate would be affected.

(E) reserve requirements would have to be increased in tandem.

10. Which of the following could potentially lead to an expansion of the money supply?

(A) The central bank increases the discount rate.

(B) The central bank decreases the interest rate on bank reserves.

(C) The federal government increases its spending.

(D) The central bank increases reserve requirements.

(E) Taxes are reduced.

11. Assume the reserve requirement is 10 percent. If the central bank sells $29 million worth of government securities in an open market operation, then the money supply can

(A) increase by $2.9 million.

(B) decrease by $2.9 million.

(C) increase by $290 million.

(D) decrease by $290 million.

(E) increase by $26.1 million.

12. Assume the reserve requirement is 5 percent. If the central bank buys $4 million worth of government securities in an open market operation, then the money supply can

(A) increase by $1.25 million.

(B) decrease by $1.25 million.

(C) increase by $20 million.

(D) decrease by $20 million.

(E) increase by $80 million.

13. An increase in the discount rate ______ the monetary base and therefore M1 ______.

(A) increases; is unaffected

(B) increases; increases

(C) increases; decreases

(D) decreases; increases

(E) decreases; decreases

14 Increasing the interest rate paid on reserves incentivizes depository institutions to hold ______ reserves and make ______ loans and investments.

(A) more; riskier

(B) more; more

(C) more; fewer

(D) fewer; more

(E) fewer; fewer

15. If depositors across the economy decide to hold less currency and more demand deposits, then bank reserves ______ and M1 ______.

(A) increase; decreases

(B) increase; increases

(C) decrease; decreases

(D) decrease; increases

(E) decrease; is unaffected

Free-Response Review Questions

1. Assume the reserve requirement is 10 percent. If the central bank buys $10,000 worth of government securities in the secondary market, will the money supply expand or shrink? By exactly how much after all is said and done?

2. Explain why the money supply changes when the central bank buys $10,000 worth of government securities in the secondary market. Why is the change in the money supply more than $10,000?

3. Suppose that depository institutions did not use all of their excess reserves to make loans and buy investments. For example, if the reserve requirement was 10 percent, depository institutions would hold 20 percent of their deposits idle. How would this affect your answer to question 1 above?